The 93rd Survey of Projects Investment in India indicates a sharp decline in fresh investment in the third quarter of the fiscal year 2023-24 (Q3/FY24). After exhibiting a record fresh investment announcement in the last quarter of fiscal 2022-23 (Q4/FY23), fresh investment commitments by both the Government and Private sectors declined in the subsequent three quarters of fiscal 2023-24. Though the decline was somewhat moderate in the first quarter (Q1/FY24), the rate of fall intensified in the next two quarters, Q2/FY24 and Q3/FY24.

Both the Central government and the Private sector scaled back their new capital expenditure plans during the current Survey period. The fiscal constraints in the Government sector and a cautious approach by the Private sector led to the decline in fresh capex in Q3/FY24.Poor financial conditions at state levels,state elections and subsequent change in ruling governments in major states like Madhya Pradesh, Rajasthan, and Telanganaslowed down fresh capex plans of state government agencies.

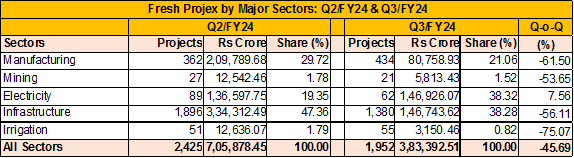

During Q3/FY24, the country saw the announcement of 1,952 new projects with a total investment commitment of Rs 3,83,392.51 crore. This indicated a fall of 45.69 percent when compared with the investment statistics for the preceding quarter (Q2/FY24). During that period, 2,425 new projects worth Rs 7,05,878.45 crore were announced.

The number of mega projects (investment of Rs 1,000 crore or more) too came down from 108 projects worth Rs4,78,519.73crore in Q2/FY24 to just 59projects worth Rs 2,20,886.88 crore in Q3/FY24.

Projex by Ownership

After an exuberant start with several super mega projects in the Sunrise industries (Green Hydrogen, Semi-conductors, Electrical Vehicles, Lithium Batteries, Data Centres, etc.) in the initial two quarters of the current fiscal year, the private sector scaled down its new capex plans in the third quarter. This shift in sentiment can be attributed to various factors, including concerns related to global economic developments, dwindling demand, and the looming General Elections.

Fresh investment announcements by the Government sector declined by 59.95% from Q2/FY24 to Q3/FY24. Within this sector, the decline was the sharpest in the Central governmentsector. After registering a growth of 66.73 percent in the last quarter of FY23, the quarterly announcement of fresh investment by the Central government sector declined by 18.48 percent, 46.59 percent, and 72.05 percent in the first three quarters of FY24 respectively. In all, during the Oct-Dec 2023 period, 175 new projects worth Rs 29,751 crore were announced in this sector. The Central government seems to have opted for fiscal consolidation by restraining the initiation of new projects in this fiscal.

Fresh investment at state government levels after posting a good growth of 30.75 percent in the first quarter of this fiscal, declined in the next two quarters to 8.03 percent and 53.50 percent. In Q3/FY24, state-owned agencies announced 613 new projects worth Rs 92,897.78 crore. Compared with the decline seen in the Government sector, the decline in the Private sector was comparatively milder at 34.76 percent.

The Private sector registered a 0.48 percent growth in Q2/FY24 but could not sustain the growth in Q3/FY24. During the latest quarter, the sector announced 1,164 new projects worth Rs 2,60,743.63 crore. Though the Private sector announced 118 more projects as compared to the preceding quarter, a fall in the number of big-ticket projects from 71 to 42resulted in the fresh investment declining by 34.76 percent.

A slowdown in global economic growth, uncertain international geopolitical environment, and below-normal monsoon, which in turn delayed the revival expected in rural demand and the upcoming General Elections might have made the private companies hold back their new capex plan for a while. Further, the sector has already announced fresh investments of around Rs 18,47,669.39 crore in the preceding four quarters. Execution of those proposals will be the first priority of the private promoters.

Projex by Sectors

The sharp decline in fresh investment witnessed in the Oct-Dec 2023 period was spread across almost all major sectors. Barring the Electricity sector, all other major sectors saw contractions in fresh investments of more than 50 percent.

The 11 mega hydel power projects announced in the third quarter helped the Electricity sector to post 7.56 percent growth in terms of fresh investment on a Q-o-Q basis. In all, during the quarter the sector saw the announcement of 62 new projects worth Rs 1,46,926.07 crore. Apart from the 11 mega Hydel power projects, the total also includes seven Solar power and one Coal-based mega power project.

The Manufacturing sector registered sequential declines of 77.58 percent, 2.31 percent, and 61.50 percent respectively in the first three quarters of FY24. During the Oct-Dec 2023 period, 434 new projects worth Rs 80,758.93 crore were announced. Within the Manufacturing sector, other than Electrical Machinery, Pharma, Plastic Products, and Paper Products all other sub-groups recorded sharp declines in fresh capex plans. The all-important Automobiles, Steel, and Cement sectors saw fresh investments decline by 63.77 percent, 74.80 percent, and 88.97 percent, respectively.

The Infrastructure sector, where new investment commitments by the State and Central government are the highest, recorded a decline in fresh investment for the second quarter in a row. In the first quarter of FY24, fresh investment had increased by 31.41 percent but in the subsequent second and third quarters, such investments declinedby 10.90 percent and 56.11 percent, respectively.

Within the Infrastructure sector, barring the Hospital sector, all other major sub-sectors posted negative Q-o-Q growths of over 50 percent. These included Community Services, Construction, Water, Roadways, Railways, and Power Distribution.

As against 336 new Roadway projects worth Rs 58,800 crore announced in Q2/FY24, only 194 projects worth Rs 25,904 crore were announced in Q3/FY24. In the Railways sector, the decline was deep with only 28 new projects worth Rs 5,758.60 crore announced in Q3/FY24 against 48 new projects worth Rs 74,011 crore announced in the preceding quarter.

The decline in the Construction sector (comprising Commercial Complexes, Real Estate, and Industrial Parks) compared with other major sub-sectors, was moderate at 21.54 percent. As compared to 628 new projects worth Rs 1,03,681 crore announced in Q2/FY24, 675 projects worth Rs 81,350 crore were announced in the third quarter.

The Mining and Irrigation sectors too experienced sharp declines in the announcement of fresh investment during the third quarter of the current fiscal.

Projex by State

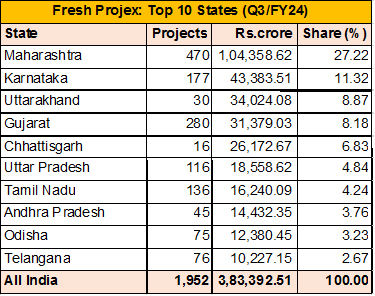

In the third quarter of the fiscal 2024, large states facing financial constraints trimmed their capex spending. Additionally, four major states - Chhattisgarh, Madhya Pradesh, Rajasthan, and Telangana underwent elections and saw changes in governments. This period of uncertainty led to a fall in fresh investment in three of these major states.The decline in fresh investment commitments by the private sector worsened the matter. As a result, most of the major states saw fresh investment declining by more than half as compared to the preceding quarter's investment statistics. Some of the states that managed to dodge the fall in fresh investment intentions were Chhattisgarh, Maharashtra, Punjab, and Uttarakhand.

Maharashtra not only posted growth of 22.85 percent in fresh investment but also topped the table with a total investment of Rs 1,04,358.62 crore. The state alone accounted for 27.22 percent of the total fresh investment emanated in Q3/FY24. The state also emerged as the most favoured destination of private promoters by attracting 366 private projects worth Rs 91,689.65 crore. Of the 59 mega projects worth Rs 2,20,886.88 crore announced in Q3/FY24, the state cornered 11 mega projects worth Rs 62,190 crore.

Three mega power projects helped Chhattisgarh to attract a total of Rs 26,172.67 crore fresh investment and post a growth of 398.41 percent on a Q-o-Q basis. The three power projects were,a Rs 13,600 crore 1,600 MW Coal based power project of Adani Power, a Rs 5,761.50 crore 1,200 MW Pumped Hydropower project of Sterlite Grid and a Rs 4,697.12 crore 1,000 MW Pumped Storage Hydropower project of Jindal Renewable Power.

Like Chhattisgarh, Uttarakhand too could post healthy growth in fresh investment in Q3/FY24 due to the announcement of three Hydel-based power projects, two Solar powerprojects and a Paper Boards project of ITC Ltd. In all, the state attracted 30 new projects worth Rs 34,024.08 crore in Q3/FY24.

Top Five States

Maharashtra, Karnataka, Uttarakhand, Gujarat, and Chhattisgarh topped the fresh investment table in that order. Maharashtra topped in all three parameters – Number of new projects, Aggregate fresh investment, and Private investment.

The second ranked Karnataka attracted 11.32 percent of the total fresh investment emanated in Q3/FY24 in the form of 177 new projects worth Rs 43,383.51 crore. Of the 177 new projects, 7 projects worth Rs 29,201 crore were of mega size.

The third ranked Uttarakhand saw announcements of 30 new projects worth Rs 34,024.08 crore. By attracting 9.70 percent of the fresh private capex, the state emerged as the second most favourite destination of private investors.

The fourth ranked Gujarat saw announcements of 280 new projects worth Rs 31,379.03 crore. Of this, 196 projects of Rs 20,729.47 crore were by Private promoters. The state is holding a Global Investors meet in January 2024 to elicit fresh private capex from both Indian and foreign companies.

The fifth ranked Chhattisgarh secured the position mainly because of the 3 mega power projects announced in the state just before the announcement of state election.

Outlook

The decline in fresh investment announcements during the third quarter of FY24 can be attributed to a combination of factors, including reduced capex initiatives at the state levels, state elections, private sector caution stemming from global economic developments and decreased demand, and the impending General Elections. Additionally, the Central government's efforts to exercise fiscal restraint too contributed to this phenomenon.

Projects Today expects announcements of freshinvestment plans to remain tepid in the last quarter of the fiscal year 2023-24. Indian businessmen are hopeful that the new government, which will take charge in the first quarter of FY25, willnot only continue the current investor-friendly policiesbut also unleash more economic reforms. This is required to keep the India growth story intact.

About Projects Today

Projects Today is India's largest online databank on new and ongoing projects in India. The website, launched on 8 September 2000, aims to provide the required foresight to its clients based on sectoral insights its research team possesses. The project-related information provides an invaluable marketing resource to assist the business development efforts of the organisations that focus on the new projects market. It is widely used by the project fraternity, primarily, as a business opportunity identifier.

Projects Today conducts Survey of Project Investment, at the end of every financial quarter to gauge the trends in projects investment in India by sectors, state, ownership, etc.

Disclaimer : The opinions expressed within this interview are the personal opinions of the interviewee. The facts and opinions appearing in the answers do not reflect the views of Indiastat or the interviewer. Indiastat does not hold any responsibility or liability for the same.

... Read more